Yesterday I wrote a lengthy article about exclusive use Next Generation 3.0 air tanker contracts, the Aerial Firefighting Use and Effectiveness study, air tanker availability since 2000, and the contracts that were awarded recently for Call When Needed (CWN) large and very large air tankers.

Today I added some calculated data to that article about the cost per delivered gallon from the CWN air tankers. In an effort to ensure this additional information does not get lost, I am including it again here.

Keep in mind the costs only apply to CWN air tankers which can be more than 50 percent higher than an exclusive use air tanker that is guaranteed several months of work. The initial dollar figures supplied by the Forest Service are based on the contracts that were awarded in December, 2019.

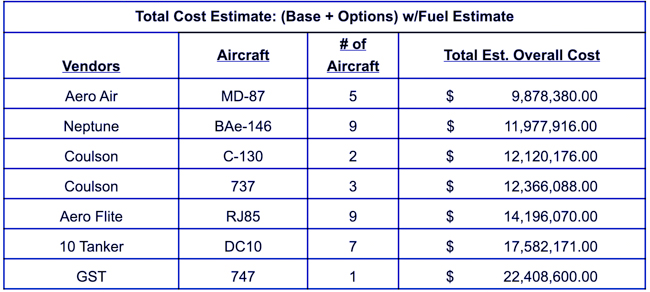

The U.S. Forest Service refused to give us the actual daily and hourly costs that the government agreed to when issuing the new CWN contracts to the six companies, but did supply the chart below with estimates based on the contract costs. The data assume the tankers were activated 36 days a year, for 4 years, and flew 100 hours each year. The dollar figures also include the estimated fuel costs based on each aircraft’s fuel burn rate at a fuel price of $5.21 a gallon.

In comparing the dollar figures, note that the listed air tankers can carry up to 3,000 to 4,000 gallons in each load, except the DC-10 and 747 which can hold up to 9,400 and 19,200 gallons respectively.

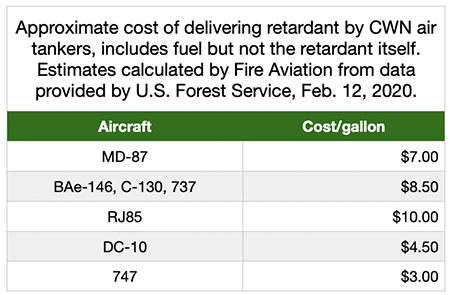

With the very different capacities of the seven models of air tankers receiving the CWN contracts, using just the USFS data above it is difficult to analyze and compare the actual costs of applying retardant. I did some rough back-of-the-envelope cyphering assuming 3,500-gallon retardant capacities for all aircraft except the DC-10 and 747, and 9,400 and 19,200 gallons respectively for those two very large air tankers. Other assumptions were, 36 days availability a year for four years and one load per hour for a total of 400 hours. The approximate, ball park costs per gallon delivered by a Call When Needed air tanker that was awarded a USFS CWN contract in December, 2019, rounded to the nearest half-dollar and including fuel but not the costs of retardant, are:

These dollar figures are very, very rough estimates. In some air tankers the amount of retardant carried varies with density altitude and the amount of fuel on board, which increases the cost per delivered gallon. The expense of retardant would add several dollars per gallon but would be the same for each aircraft.

Call When Needed air tankers are usually much more expensive per day and hour compared to Exclusive Use Air Tankers which are guaranteed several months of work. CWN air tankers may never be activated, or could sit for long periods and only fly a small number of hours. Or, they may work for a month or two if the Forest Service feels they can pay for them out of a less restrictive account.

In 2017 the average daily rate for large federal CWN air tankers was 54 percent higher than aircraft on exclusive use contracts.

Bradford Beck, COO of

Bradford Beck, COO of