(Updated Feb. 24, 2020)

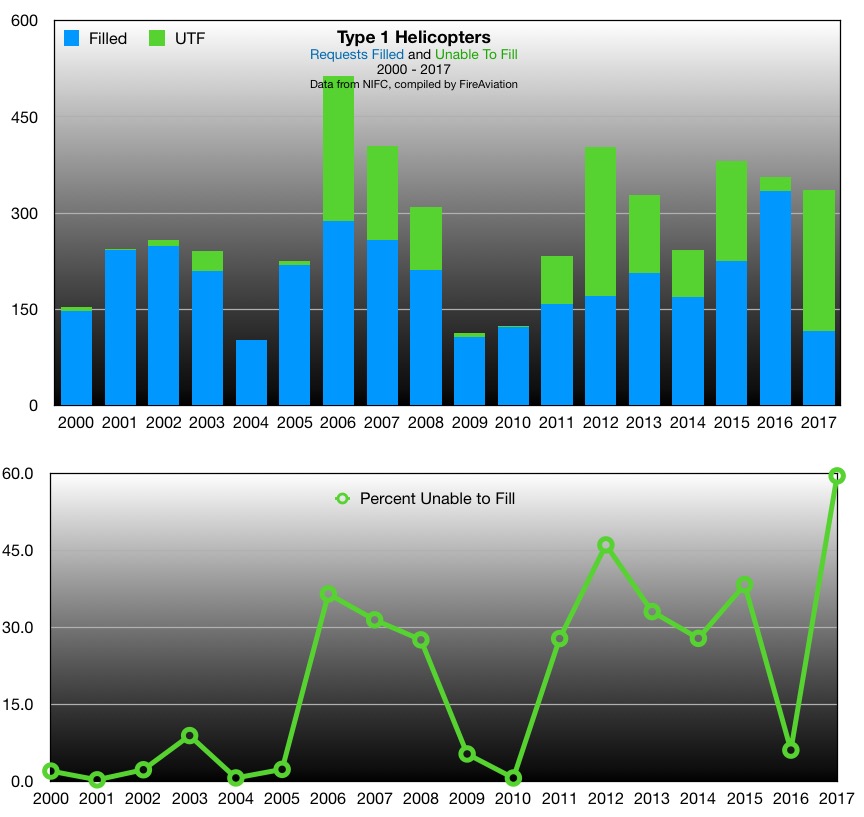

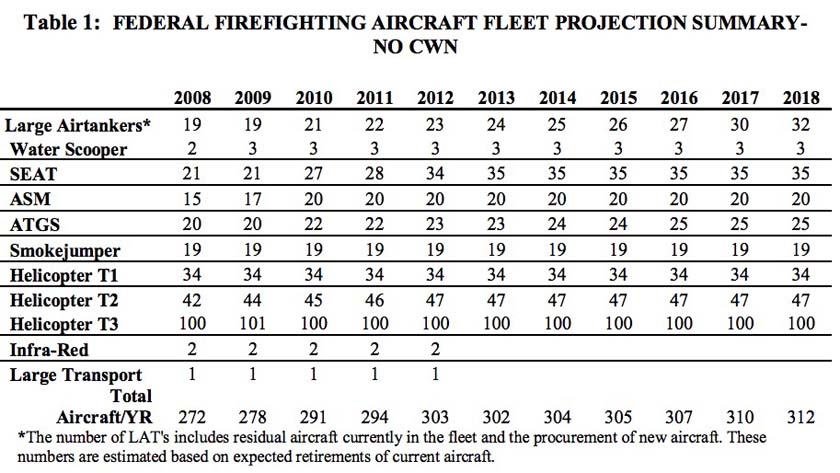

This chart shows data from 2000 through 2019 for the number of large air tankers (LAT) on U.S. Forest Service Exclusive Use (EU) Contracts, the number of times each year large air tankers were requested by firefighters on a wildfire, and the percentage of requests that were not filled (Unable to Fill, UTF).

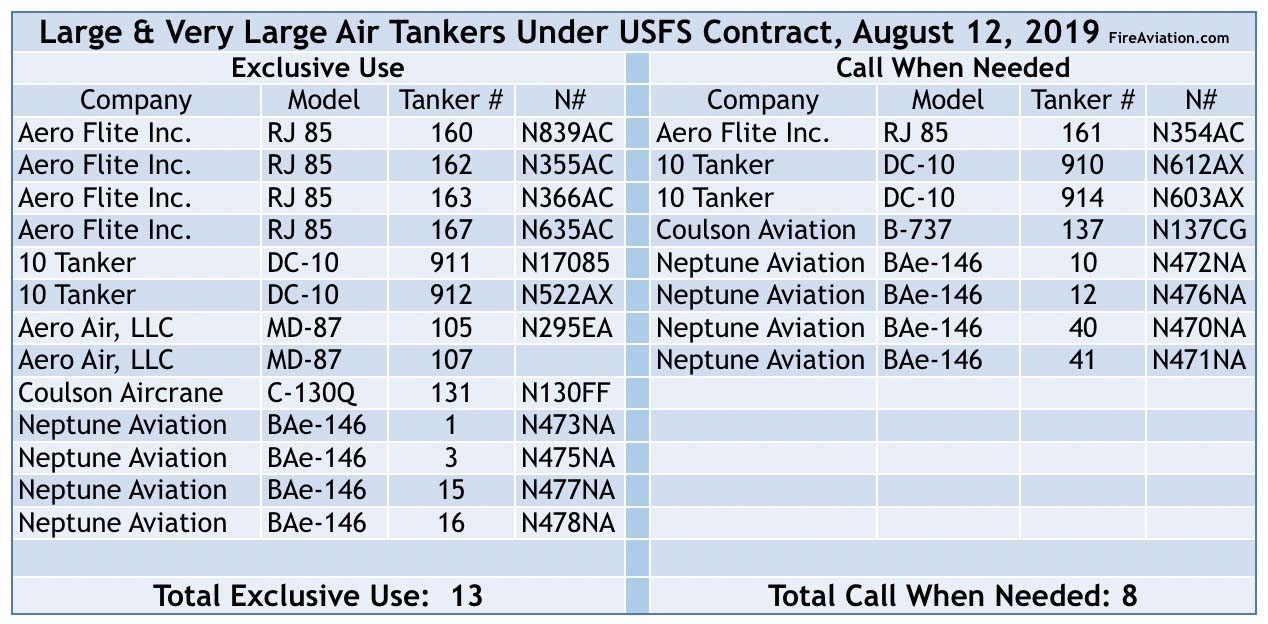

New Call When Needed contracts

More information is now available about the Large Air Tanker Call When Needed (CWN) contracts that were awarded in December, 2019. Six companies have a total of 36 aircraft on the list, a number of aircraft that is one more than first announced.

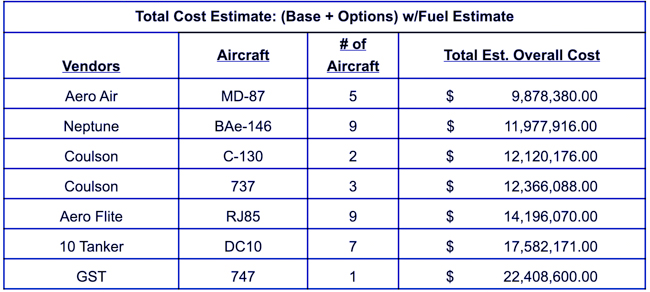

The costs below are estimates provided by the Forest Service for one aircraft based on the contracts awarded. Kaari Carpenter, a Lead Public Affairs Specialist for the Forest Service who sent us the information, told us that the estimates assume 36 days a year, for 4 years, and 100 flight hours a year. The dollar figures also include the estimated fuel costs based on each aircraft’s fuel burn rate at a fuel price of $5.21 a gallon.

In comparing the dollar figures, note that the listed air tankers can carry up to 3,000 to 4,000 gallons in each load, except the DC-10 and 747 which can hold approximately 9,400 and 19,200 gallons respectively.

Update February 13, 2020. With the very different capacities of the seven models of air tankers receiving the CWN contracts, using just the USFS data above, it is difficult to analyze and compare the actual costs of applying retardant. I did some rough back-of-the-envelope cyphering assuming 3,500-gallon retardant capacities for all aircraft except the DC-10 and 747, and 9,400 and 19,200 gallons respectively for those two very large air tankers. Other assumptions were 36 days availability a year for four years and one load per hour for a total of 400 hours. The approximate, ball park costs per gallon delivered by a Call When Needed air tanker that was awarded a USFS contract in December, 2019, rounded to the nearest half-dollar and not including the costs of retardant, are: $7.00: MD-87 $8.50: BAe-146, C-130, & 737 $10.00: RJ85 $4.50: DC-10 $3.00: 747 These dollar figures are very, very rough estimates. In some air tankers the amount of retardant varies with density altitude and the amount of fuel on board. Call When Needed air tankers are usually much more expensive per day and hour than Exclusive Use Air Tankers which are guaranteed several months of work. CWN air tankers may never be activated, or could sit for long periods and only fly a small number of hours. Or, they may work for a month or two if the Forest Service feels they can pay for them out of a less restrictive account. In 2007 the average daily rate for large federal CWN air tankers was 54 percent higher than aircraft on exclusive use contracts.

The CWN contract was awarded 555 days after the process began May 30, 2018 — the exact amount of time it took to award the first Next-Generation EU air tanker contracts, Version 1.0, in 2013.

Exclusive Use Next Generation 3.0 contracts

And speaking of long time frames, it has been 450 days since the Forest Service published the solicitation for the third round of EU Next Gen air tankers, Ver. 3.0, on November 19, 2018. Bids were required 12 months ago. Ms. Carpenter told us today that the FS expects it to be awarded in “early March, 2020.”

Aerial Firefighting Use and Effectiveness study

The Aerial Firefighting Use and Effectiveness study began approximately 2,812 days ago in 2012 and to date no substantive results have been released, other than a two-page “fact sheet”. Senator Lisa Murkowski asked about the study during a Congressional hearing April 9, 2019 and FS Chief Vicki Christiansen told her a report would be released “soon”. Ms. Carpenter told us today it would be released in the Spring of this year, 2020.

In the hearing 10 months ago Colorado Senator Cory Gardner referred to the study, saying in his rapid-fire speaking style: “There is a technical term I want to use to describe the length of time it is taking to get that study done, and it is bunk! I’m sorry, it’s just a bunch of bunk that it has taken seven years to get this done. We fought a world war in four years, we built the Pentagon in 16 months, we can’t do a study in 2 years, 1 year, 3 years, 4 years, maybe 5 years? It has taken seven years to do this? In the meantime we have western states that have had significant and catastrophic fires. I understand it’s important to get the information right. But doggonnit, someone needs to get a fire lit underneath them to get something done on this study.”

When asked if firefighting aircraft were worth the cost and if they were effective, the answers from land management agencies have often been, “Yes”.

How do you know?

“We just do”. (I’m paraphrasing here).

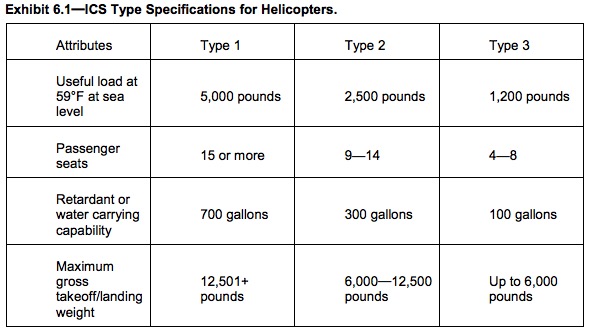

The study is supposed to quantify the effectiveness of the various types of fixed and rotor wing aircraft when they are used on wildfires. Theoretically this would better justify the hundreds of millions of dollars spent by the Forest Service on firefighting aircraft. In FY 2017 for example, the agency spent over half a billion dollars on fire aviation; $507,000,000. If completed and the results implemented, the study could make it possible to answer the question: “What are the best mixes of aircraft to do any fire suppression job?” Data collected from this study and other sources would be used to inform decisions about the composition of the interagency wildland firefighting aircraft fleet — to use the best, most efficient tools for the job.

Last year one person familiar with the issue told me that they thought the actual, accurate data from the AFUE would never be released — like the situation with the RAND air tanker study that the Forest Service never released even after our Freedom of Information Act request. Two years after it was completed RAND released the document.